John Park MSP (Mid Scotland & Fife, Scottish Labour) asked to call for costly AIB contracts scrutiny DOCUMENTS obtained by Scottish Law Reporter in connection with a sequestration of a client ordered by Perth Law Firm Kippen Campbell have revealed an MSP has been asked to call for the cancellation of highly profitable state funded contracts between the Accountant in Bankruptcy (AIB) & WYLIE & BISSET LLP, a firm of Glasgow accountants who blocked a disabled person’s access to bank accounts containing his state disability benefits for more than SEVEN MONTHS.

John Park MSP (Mid Scotland & Fife, Scottish Labour) asked to call for costly AIB contracts scrutiny DOCUMENTS obtained by Scottish Law Reporter in connection with a sequestration of a client ordered by Perth Law Firm Kippen Campbell have revealed an MSP has been asked to call for the cancellation of highly profitable state funded contracts between the Accountant in Bankruptcy (AIB) & WYLIE & BISSET LLP, a firm of Glasgow accountants who blocked a disabled person’s access to bank accounts containing his state disability benefits for more than SEVEN MONTHS.

The pleas to MSP John Park (Scottish Labour, Mid Scotland & Fife) come amid investigations into an on-going scandal involving the flow of millions of pounds of public money to firms of private accountants acting as ‘arms-length’ agents for hugely overstaffed Scotland’s Accountant in Bankruptcy, its luxurious headquarters located in Kilwinning, North Ayrshire.

The scandal of the multi million pound contracts, recently reported by popular Scots law blog “Diary of Injustice” have revealed a mere six firms of accountants are soaking up over EIGHT MILLION POUNDS of public money dealing with thousands of sequestration cases handed to them by the AIB.

Between April 2009, until 31 March 2012, Armstrong Watson has been paid £1,051,627.12 for the administration of 2062 cases on behalf of The Accountant in Bankruptcy.

Between April 2009, until 31 March 2012, Hastings & Co have been paid £608,605.96 for the administration of 1040 cases on behalf of The Accountant in Bankruptcy.

Between April 2009, until 31 March 2012, Invocas has been paid £284,346.77 for the administration of 875 cases on behalf of The Accountant in Bankruptcy.

Between April 2009, until 31 March 2012, KPMG has been paid £3,706,744.79 for the administration of 6585 cases on behalf of The Accountant in Bankruptcy.

Between April 2009, until 31 March 2012, Miller McIntyre & Gellatly (now mmg archbold) have been paid £303,745.48 for the administration of 710 cases on behalf of The Accountant in Bankruptcy.

Between April 2009, until 31 March 2012, Wylie & Bisset have been paid £2,066,686.50, for the administration of 3703 cases on behalf of The Accountant in Bankruptcy.

A legal insider who claims many of the firms are forcing people to pay their fees and sign up to unfair trust deeds, some of which have been running for years over their agreed timescale, has dubbed the AIB agent contract scheme “a bigger racket than legal aid”.

The legal insider also claimed many of those operating on behalf of the AIB appear to have been engaged in unregistered hospitality & professional lobbying efforts with local & Holyrood based politicians and civil servants at the Scottish Government. The insider went on to suggest such connections as a reason why the brewing scandal involving the unfair seizure of disability benefits by rich accountants paid millions from the public purse has attracted little parliamentary attention until now.

No one was available from Mr Park’s office to offer comment at time of going to publication, however, an insider at the AIB has acknowledged there are significant problems with agents who appear to be running up fees for unnecessary work in cases where there is little or no hope of any return.

SEIZE YOUR BENEFITS, GRAB YOUR HOUSE & RUN : Scottish Law Reporter previously exposed Glasgow accountants Wylie & Bisset who blocked a disabled victim’s access to benefits, then tried to seize his rented house for a small debt relating to disputed legal fees :

Accountant in Bankruptcy agents try to seize wrong house in bankruptcy of disabled client ordered by Perth law firm over disputed legal fees

Perth lawyers bankrupted ill client on benefits for disputed fees. A BANKRUPTCY ordered by Perth law firm Kippen Campbell against a severely ill client in receipt of disability benefits, over disputed legal fees of around £2,700 in connection with a damages claim in Scotland’s Court of Session which curiously collapsed under the law firm’s representation has today been highlighted as an example of harassment by Scots law firms for questionable fees after revelations in the media that agents acting for Scotland’s Accountant in Bankruptcy threatened to seize property belonging to a family completely unconnected to debts which Kippen Campbell claim are owed to them.

Perth lawyers bankrupted ill client on benefits for disputed fees. A BANKRUPTCY ordered by Perth law firm Kippen Campbell against a severely ill client in receipt of disability benefits, over disputed legal fees of around £2,700 in connection with a damages claim in Scotland’s Court of Session which curiously collapsed under the law firm’s representation has today been highlighted as an example of harassment by Scots law firms for questionable fees after revelations in the media that agents acting for Scotland’s Accountant in Bankruptcy threatened to seize property belonging to a family completely unconnected to debts which Kippen Campbell claim are owed to them.

Wylie & Bisset – Your house or someone else’s house to pay your ex lawyers fees :

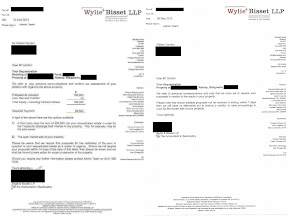

Threatening letters – Pay up for lawyers fees or we make you homeless say AIB’s agents. In letters sent to Mr Gordon, Wylie & Bisset demand a “required payment” of NINETY TWO THOUSAND & FIVE HUNDRED POUNDS, and goes on to threaten “We require firm proposals for the realisation of the sum in question to your sequestrated estate as a matter of urgency. Should we not receive your proposals within 14 days of the date of this letter, then please be aware that we shall be forced to seek action for vacant possession of the property.”.

Threatening letters – Pay up for lawyers fees or we make you homeless say AIB’s agents. In letters sent to Mr Gordon, Wylie & Bisset demand a “required payment” of NINETY TWO THOUSAND & FIVE HUNDRED POUNDS, and goes on to threaten “We require firm proposals for the realisation of the sum in question to your sequestrated estate as a matter of urgency. Should we not receive your proposals within 14 days of the date of this letter, then please be aware that we shall be forced to seek action for vacant possession of the property.”.

The property which Wylie & Bisset were attempting to seize and had valued, at £185,000, was located in Rattray, Blairgowrie, and owned by a family unconnected to Mr Gordon. Yet the debt allegedly owed to the Perth based law firm amounted to little more than £2,700, which now appears to have increased to some £6,600 taking into account several hearings at Perth Sheriff Court which have artificially inflated the original demand for the disputed legal fees.

The Herald newspaper also featured a report on the bankruptcy case against Mr Gordon, here :

Accountants target wrong Mr Gordon

AN accountancy firm handling the sequestration of a man was preparing to seize the home of someone with the same name.

William Gordon, who lives in a rented house in Perth, was stunned to receive letters from Glasgow-based Wylie & Bisset demanding to know how much equity he had in a detached home in Rattray, Perthshire. When he ignored the letter, another arrived telling him a professional valuation had been conducted and the firm would target his share in the equity to cover a debt of £5200 to Perth law firm Kippen Campbell.

In fact, the William Gordon who owns the home in Rattray confirmed he had no connection with his namesake.

He said: "You'd think professionals involved in such a serious business would carry out their job a bit more thoroughly."

The target of the sequestration added: "I pay rent on a modest home in Perth. Why would I be doing that if I owned a lovely detached house 15 miles away in one of the most desirable parts of Perthshire?"

Wylie & Bisset was appointed by the Accountant in Bankruptcy (AIB) to pursue the legal firm's debt. Gordon Chalmers, a partner in Wylie & Bisset, said: "It would be inappropriate for me to add anything further to what you have from the AIB on the matter."

10 comments:

So is Park going to do something or what?Taking someone's benefits away from them is a pleasure reserved for DWP not some jumped up firm of accountants who also happen to be on the public payroll for reasons not exactly clear

Oh dear why have our rubbish newspapers not caught up on this one?Is it because their accountants have threatened to pull advertising just like the lawyers do when reports of dodgy solicitors make their way into the headlines?

Come on you lot - 6 firms taking £8mil from the public coffers and no rags covering it?May as well not buy a paper then because the real news is online!

I hear ICAS (Institute of Chartered Accountants of Scotland) like to shake palms on behalf of all the firms you mentioned.This may explain how easy it is for them to scoop up all those millions from the taxpayer unnoticed.

Mr Swinney must be a keen ally of ICAS he likes to speak there and make ridiculous claims about Scotland taking on the state banking debt http://www.telegraph.co.uk/financialservices/9561480/Scotland-could-take-on-state-bank-debts.html

Mr Swinney, who is campaigning ahead of a 2014 referendum on Scottish independence, insisted that Scotland could cope with taking control of Scottish assets and liabilities, including RBS and Lloyds.

Speaking at the Institute of Chartered Accountants conference the SNP minister said that had Scotland been independent at the time of the £62bn bailouts of RBS and HBOS, now Lloyds, it would have happily jumped to rescue of its financial services industry.

However Mr Swinney pointed out that although both banks were headquartered in Edinburgh 90pc of their business was conducted in England. “We would have to have discussions about how to divide up Scotland’s assets and liabilities.”

What a ridiculous idea.Mr Swinney and his SNP will bankrupt Scotland the first chance they get but you can rest assured no member of the SNP Government will suffer financially as a result.

Should companies like KPMG get any public money from taxpayers or the Scottish Government or be involved in any kind of personal bankruptcies after being accused of systematic fraud by US regulators ?

http://en.wikipedia.org/wiki/KPMG_tax_shelter_fraud

The KPMG tax shelter fraud scandal involves allegedly illegal U.S. tax shelters by KPMG that were exposed beginning in 2003. In early 2005, the United States member firm of KPMG International, KPMG LLP, was accused by the United States Department of Justice of fraud in marketing abusive tax shelters.

Deferred prosecution agreement (after they admitted criminal wrongdoing)

Under a deferred prosecution agreement, KPMG LLP admitted criminal wrongdoing in creating fraudulent tax shelters to help wealthy clients dodge $2.5 billion in taxes and agreed to pay $456 million in penalties. KPMG LLP will not face criminal prosecution as long as it complies with the terms of its agreement with the government. On January 3, 2007, the criminal conspiracy charges against KPMG were dropped.[1] However, Federal Attorney Michael J. Garcia stated that the charges could be reinstated if KPMG does not continue to submit to continued monitorship through September 2008.[2]

http://www.msnbc.msn.com/id/3475284/ns/business-corporate_scandals/t/senate-probes-kpmg-tax-shelters

Senate probes KPMG tax shelters

Senate investigators review accounting firm’s tax shelters

By Mary Dalrymple

WASHINGTON, Nov. 17 — One of the largest accounting firms promoted dubious charitable deductions and complicated transactions to generate phony paper losses for clients, say Senate investigators who spent a year unwinding four tax products that KPMG sold to more than 350 individuals in the late 1990s and early 2000s. The firm says it no longer offers the tax strategies.

The four shelters once sold by KPMG will be scrutinized this week during two days of hearings of the Senate Governmental Affairs investigations subcommittee.

Tuesday’s testimony is to give an inside look at tax-shelter development and marketing. Thursday’s aims to reveal roles played by other financial institutions that support and enable tax sheltering.

Subcommittee aides, who handled the project with the help of anonymous whistle-blowers inside KPMG, said the transactions had virtually no business purpose other than to reduce taxes for individuals who used them.

The Internal Revenue Service ruled in 2000 that the basis for three of the four transactions make them potentially abusive shelters. The fourth, subcommittee aides said, is under investigation by the IRS.

Freezing a disabled person's access to their benefits is not acceptable treatment anywhere so I am copying links to this story round disability forums in the hopes people will join together against these accountants and their allies.

November 17, 2012

good point about kpmg so Mr Swinney why is the SNP supposedly Mr Squeaky clean Scottish Government handing out public money to a firm who admit they are criminals in the USA??

Let's be honest here, this is not bigger than the Scottish legal aid fraud but it does point to the elephant in the room....that is that why are the AIB out-sourcing this work to accountant firms in the first place?

Could it be that the AIB do not have any chartered accountants as staff?

Also, could it be that the AIB have no systems and procedures in place to effectively control and manage these out-sourced accountants because of a lack of knowledge and skill?

Is this work being contracted out as an attempt to avoid corporate responsibility, giving the AIB an excuse to apportion blame to the out-sourced firm when their corrupt practices are exposed, thereby providing an artificial screen to protect the AIB from being pursued or criticised?

This is a wickedly devised cabal?

The Law Society of Scotland must be heavily involved here as part of their increasingly insidious creeping role in corporate interference?

A firm of Glasgow accountants doing well from the public purse under Scottish Labour and the SNP..

I think we all know where this is going..

Am I the only one thats missing the obvious here, just what the hell is this Park character doing, buff all??

£5200 to Perth law firm Kippen Campbell for covering up occupational injury.

RSA insure Kippen Campbell.

RSA insure Reg Vardy Motors, most employers Mr Gordon's employers.

RSA insure Law Society of Scotland.

RSA insure sheriffs and Judges too.

Doctors including your to GP insure by RSA. All Evil scum.

Remember these professions pay premiums to the insurance company you will be claiming against. They are evil life destroyers. Don't try to sue your employer. You will lose, guaranteed.

Post a Comment