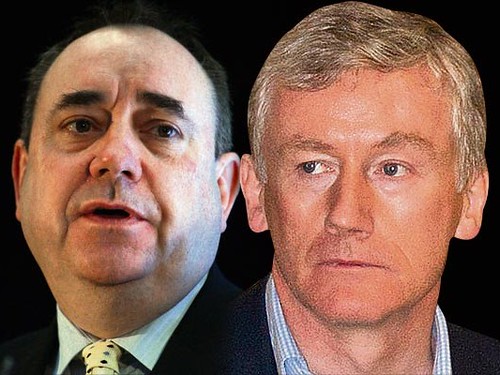

Salmond’s Lawyers help out shamed banker : Law firm awarded part of a massive £20m contract by Scottish Ministers is buying houses for Fred Goodwin. A PRIVATE FIRM OF LAWYERS working for Alex Salmond’s Scottish Government, Maclay Murray & Spens LLP (MMS) are today revealed to be helping buy properties for the former Royal Bank of Scotland Chief dubbed the “World’s Worst Banker”, FRED GOODWIN who was stripped of his knighthood last week. Maclay Murray & Spens LLP, the Scots based law firm awarded part of a little talked about TWENTY MILLION POUND Scottish Government contract after Scottish Ministers insisted they needed to employ even more lawyers than the 225 already serving Scots politicians, are reported today to be purchasing properties in possible TAX AVOIDANCE DEALS through Glasgow based VINDEX TRUSTEES Ltd a lawyer controlled DORMANT TRUST on behalf of the shamed banker Goodwin whose takeover deals caused the collapse of the Royal Bank of Scotland and nearly took the UK’s entire economy with it.

Salmond’s Lawyers help out shamed banker : Law firm awarded part of a massive £20m contract by Scottish Ministers is buying houses for Fred Goodwin. A PRIVATE FIRM OF LAWYERS working for Alex Salmond’s Scottish Government, Maclay Murray & Spens LLP (MMS) are today revealed to be helping buy properties for the former Royal Bank of Scotland Chief dubbed the “World’s Worst Banker”, FRED GOODWIN who was stripped of his knighthood last week. Maclay Murray & Spens LLP, the Scots based law firm awarded part of a little talked about TWENTY MILLION POUND Scottish Government contract after Scottish Ministers insisted they needed to employ even more lawyers than the 225 already serving Scots politicians, are reported today to be purchasing properties in possible TAX AVOIDANCE DEALS through Glasgow based VINDEX TRUSTEES Ltd a lawyer controlled DORMANT TRUST on behalf of the shamed banker Goodwin whose takeover deals caused the collapse of the Royal Bank of Scotland and nearly took the UK’s entire economy with it.

Papers obtained by newspapers have revealed the lawyer controlled Glasgow based trust Vindex Trustees Ltd have purchased a £3.1 million mansion home in Edinburgh in a deal which could allow Goodwin TO AVOID paying hundreds of thousands of pounds in tax.

In an excerpt from the Daily Mail newspaper report on the revelations :

Disgraced banker Fred Goodwin is at the centre of a new row over the purchase through a trust of a £3.1 million home – which could allow him to avoid paying hundreds of thousands of pounds in tax.

Experts say the former RBS chief executive, who was last week stripped of his knighthood, may be exploiting a legal loophole that is often used to avoid stamp duty or reduce inheritance tax. Official documents reveal that the six-bedroom mansion in Edinburgh is owned by Vindex Trustees Ltd, which is controlled by a law firm. There is no mortgage listed for the property, suggesting it was bought for cash.

One expert said such a trust arrangement could be used by a wealthy individual to reduce the amount of inheritance tax his family had to pay after his death. Under this scheme, the home owner lends a trust the money to buy the house, and then arranges for the trust to repay the original loan to his children. When the loan is repaid, the children do not have to pay inheritance tax on the sum, which could be as much as £1.2 million on a £3.1 million property.

Information on Vindex Trustees Ltd :

VINDEX TRUSTEES LIMITED Company Number SC026895

Registered Office 1 GEORGE SQUARE GLASGOW UNITED KINGDOM G2 1AL

Company Origin United Kingdom, Scotland, Glasgow,Company Status Active

Company Type PRI/LTD BY GUAR/NSC (Private, limited by guarantee, no share capital)

Incorporation Date 12/03/1949, Nature of Business 7499 - Non-trading company

Accounting Reference Date 31/05,Last Accounts Made Up To 31/05/2010 (DORMANT)

Next Accounts Due 29/02/2012,Last Return Made Up To 08/10/2010,Next Return Due 05/11/2011

MacLay Murray & Spens LLP, who are identified as controllers of Vindex Trustees Ltd in documents obtained online, were taken on by the Scottish Government in an unprecedented round of massive legal contracts awarded to private law firms last year totalling TWENTY MILLION POUNDS, even though the Scottish Government already has well over TWO HUNDRED LAWYERS working for it in-house, at well over TEN MILLION POUNDS cost to taxpayers.

The full list of law firms who won the tenders to provide extra legal advice to the Scottish Government are :

Contract, commercial and corporate – Dundas & Wilson CS; DLA Piper Scotland; Morton Fraser; MacRoberts; Pinsent Masons

Debt recovery: Harper Macleod; Maclay Murray & Spens; McGrigors; MacRoberts; Morton Fraser

Litigation, inquiries and employment: Anderson Strathern; Brodies; DLA Piper Scotland; Ledingham Chalmers; Morton Fraser

Major projects: Biggart Baillie; Dundas & Wilson CS; DLA Piper Scotland; MacRoberts; Pinsent Masons Property: Harper Macleod; DLA Piper Scotland; Ledingham Chalmers; McGrigors; Morton Fraser

The Scottish Government’s tender for the intake of law firms at vast taxpayer’s expense can be viewed online here : CONTRACT AWARD NOTICE £20 Million for a panel of law firms for four years although many of the web links contained within the tender which link back to the Scottish Government's website go to non-existent pages.

A more detailed report along with revelations many of the law firms who won contracts with the Scottish Government had also been involved in offering hospitality to Scottish Government officials & Civil Servants, was published after an investigation by popular Scots law blog ‘Diary of Injustice’, HERE

BBC News reported First Minister Alex Salmond said last week he ‘regretted’ supporting Goodwin in the past, however there was no one at the Scottish Government to respond to questions on why Scottish Ministers should be awarding law firms who are dealing in potential tax avoidance schemes huge public funded contracts. Mr Goodwin was also not available for comment.

7 comments:

I wonder if Douglas Mill - employed by Glasgow University's Law Department - played any part in this for his pal Fred?

Cant help wondering why the papers forget to include all this sleaze in their incomplete coverage.. or have I just answered my own question?

There used to be this television series called *anker and the Fatman

Is this pair doing the remake?

why Scottish Ministers should be awarding law firms who are dealing in potential tax avoidance schemes huge public funded contracts

correct

Why is taxpayers money courtesy of Alex Salmond funding tax avoiders AGAIN ??

How fitting.

The man who wants to destroy the union doles out millions to the same lawyers working for the man who nearly broke the entire country and helped throw millions out of work.

Ha!

Caught red handed again but you can bet we will hear little of it in the papers.For some reason the papers haven't even mentioned the law firm involved (really weird especially since they are getting plenty from Salmondella's tin pot Govt)

So when was the last time some normal guy in the street decided to use an expensive law firm to buy a mansion through a dormant trust?

Answer probably never because the lawyers will end up charging as much as the house to do it!

In principle and in law, such a Trust would place Fred Goodwin and his legal representatives in possession of a Constructive Notice and Constructive Trust, setting up a Trust which, it would seem, is a disposition made with the intention to defeat, which is a criminal offence. The Tax Authorities can claw back such transactions with the use of already res judicata CA.The consolidation of property Act 1925.

Post a Comment